Keep in line with contract compliance

Achieve a collaborative single truth and cover a broad variety of contracting procedures including early warnings, compensation events, programme submission, payment and much more.

Make contracts easy

CEMAR is a dedicated contract management solution for NEC, FIDIC and other contract types. Created from a first-hand need to manage administrative demands, it has been developed by industry experts and practitioners and is acknowledged by name in all NEC4 contracts.

Achieve a collaborative single truth and cover a broad variety of contracting procedures including early warnings, compensation events, programme submission, payment and much more.

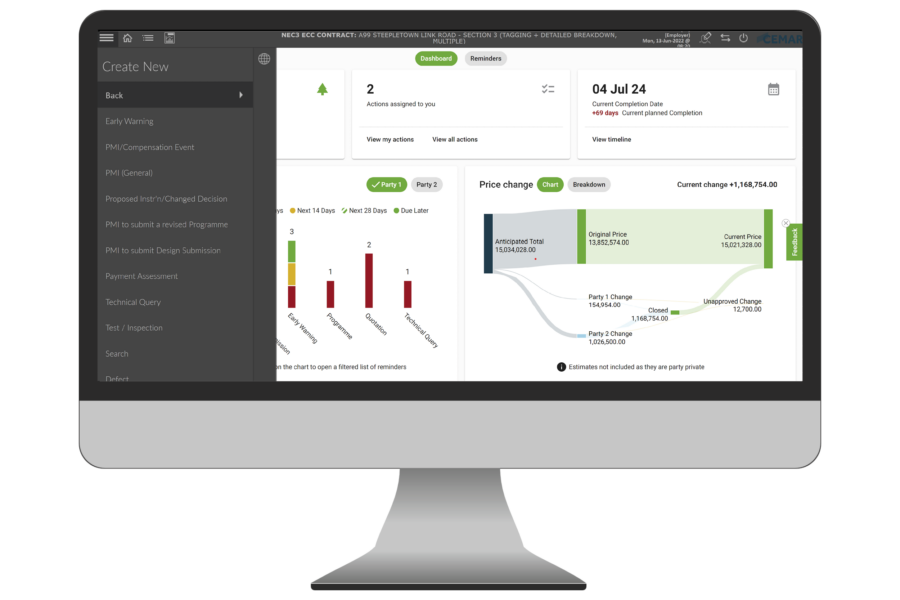

CEMAR Analytics provides a single source of truth for Contract Management information to fully understand your contract portfolio. Drill down into your data and export them to get fresh business insights. Easily generate the reports tailored to your business needs.

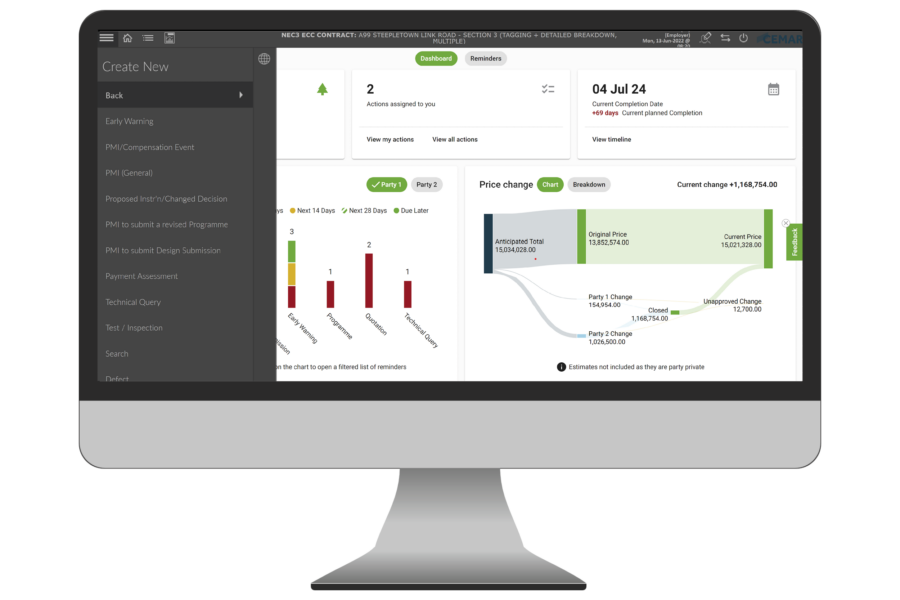

The Contract dashboard visualises contract reminders and outstanding actions for your Contract. Get an overview of the status of your contract, dates, prices or time for completion at one glance, and always be up to date with actions & reminders.

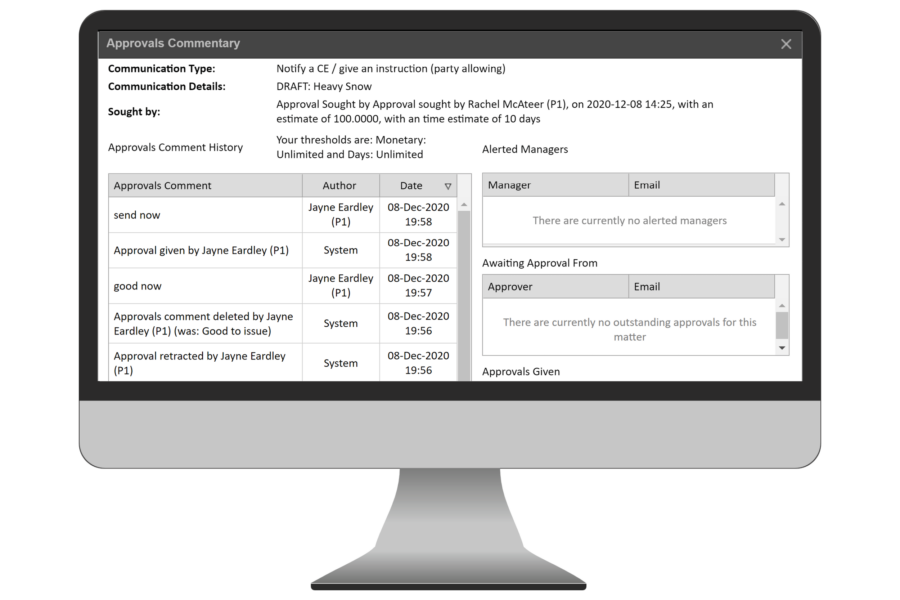

Teams can collaborate on drafting, reviewing and event communication, with all approvals captured in a party-private audit log. CEMAR also maintains an audit of history, common event registers and actions with unique numbering, time, and date stamps.

Discover Thinkproject Academy!

Click here to learn more.

Setting new standards

Upgrade your efficiency

Fill in our form and one of the Thinkproject team will contact you as soon as possible.

We look forward to hearing from you!

Information provided will only be used to answer your request. To receive information about upcoming events, industry trends and information relating to digitalisation, BIM and more, please tick the field to opt in. We take the security of your data seriously.